|

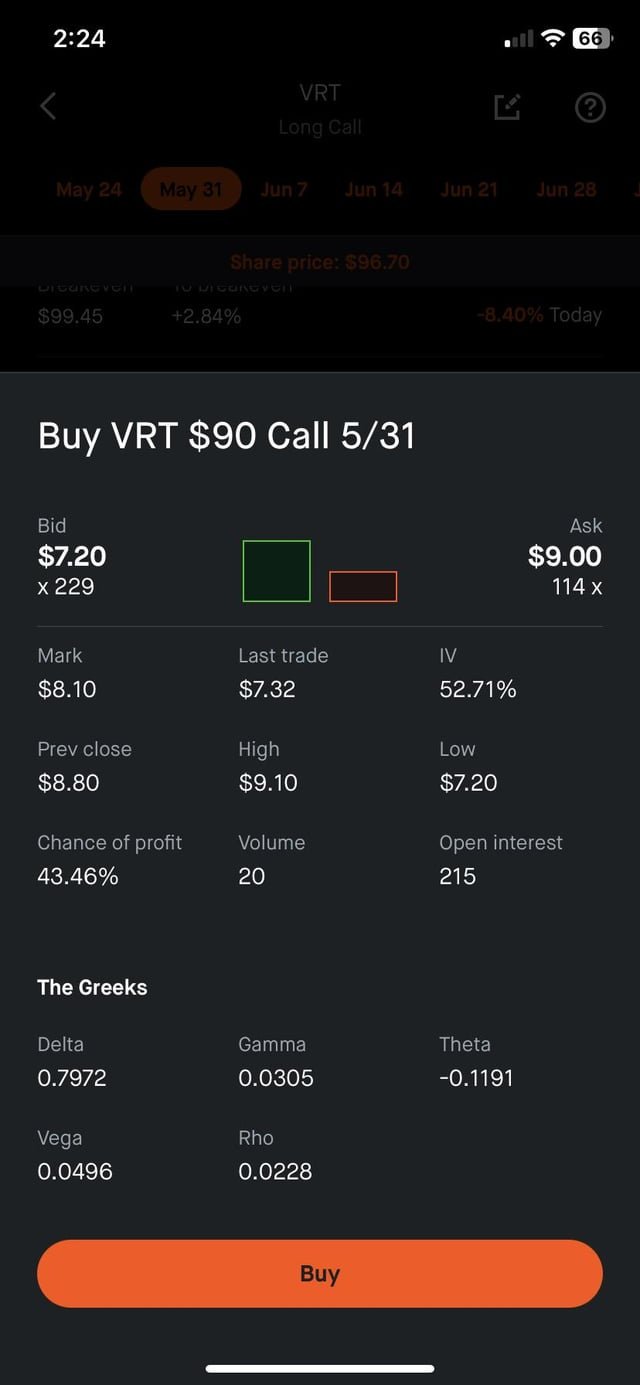

To whom it may concern, I have mostly started using brokerage accounts instead of conventional savings accounts to try and get bigger returns on the money I’m putting away. Over the last year and a half, every investment has been the basic purchasing shares. My brokerage account goes up and down like everyone else’s, but I have averaged more profit than I would with it just sitting in a savings account. Over the last few months I have been very interested in learning and understanding the options side of trading, reading books and trying to get hands on experience with various paper trading apps…. But I haven’t had the guts to pull the trigger on a single call or put because I don’t fully understand the information I am looking at. Is there anyone here that would take the time to break down the information on this options purchasing ticket? An in depth response on the what, why, and how of each category would be greatly appreciated. submitted by /u/Top_Orange1982 |

Source link