|

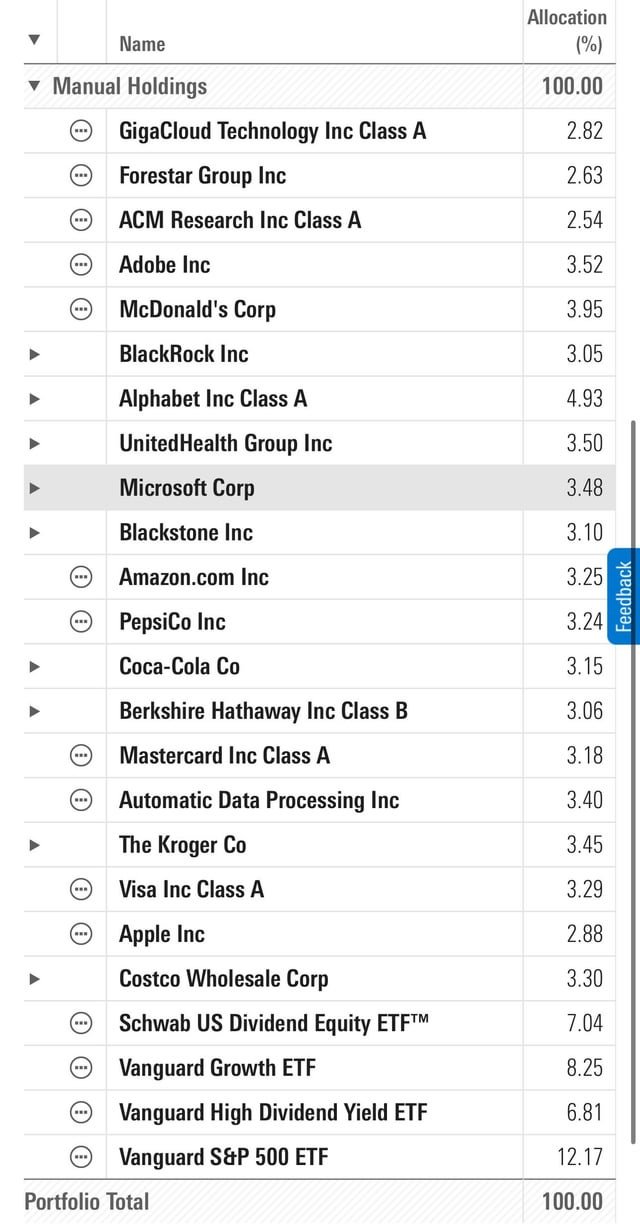

At the moment I have 175k invested in the following allocations GCT FOR ACMR VOO – 12.17% VUG – 8.25% SCHD – 7.04% VYM – 6.81% Google – 4.93% Microsoft – 3.48% Apple – 2.88% Amazon – 3.25% Mc Donalds – 3.95% Pepsi – 3.24% Adobe – 3.52% United Healthcare – 3.50% Coca Cola – 3.15% Visa – 3.29% Costco – 3.30% Automatic Data Processing Inc – 3.40% Kroger – 3.45% Mastercard – 3.18% Blackrock – 3.05% Berkshire.B – 3.06% Blackstone Group – 3.10% GigaCloud Technology Inc – 2.82% Forester Group – 2.63% ACM Research Inc – 2.54% So in Summary TDLR Growth, small cap stocks – 8% Growth, large cap stocks – 16% About 42% of the portofolio are growth and value but have a history of dividend growth and consistent payment for the last 10 years Any advice would be greatly appreciated Question people usually ask: 1. Do you need cash in the short term? No, I have a business with great cashflow and profits

submitted by /u/NearlyMemorable |

Source link