audioundwerbung/iStock via Getty Images

The Industrial Select Sector (XLI) fell (-0.28%) for the week ending May 17 after gaining three weeks in a row, while the SPDR S&P 500 Trust ETF (SPY) rose (+1.65%) climbing four weeks on the trot.

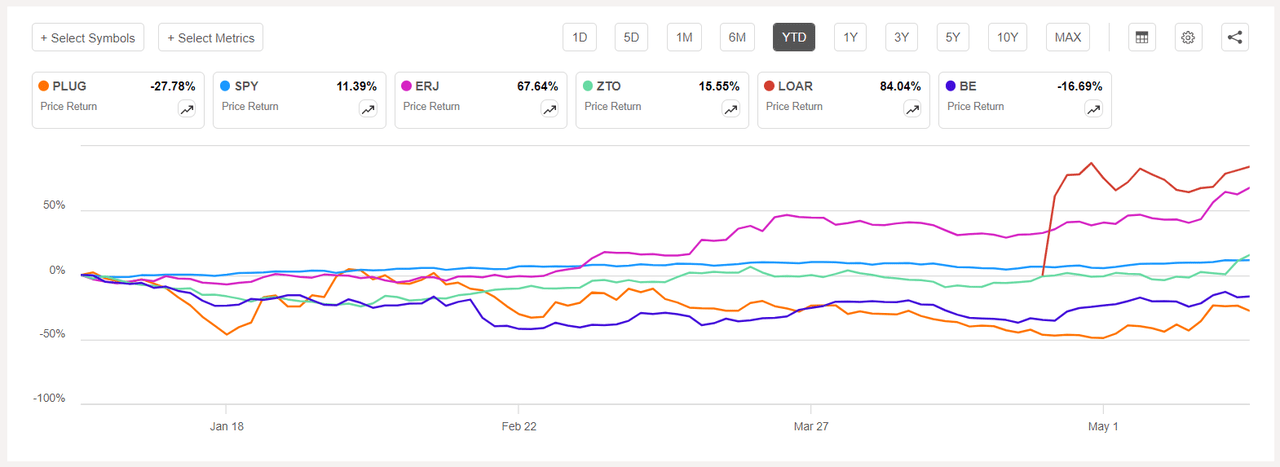

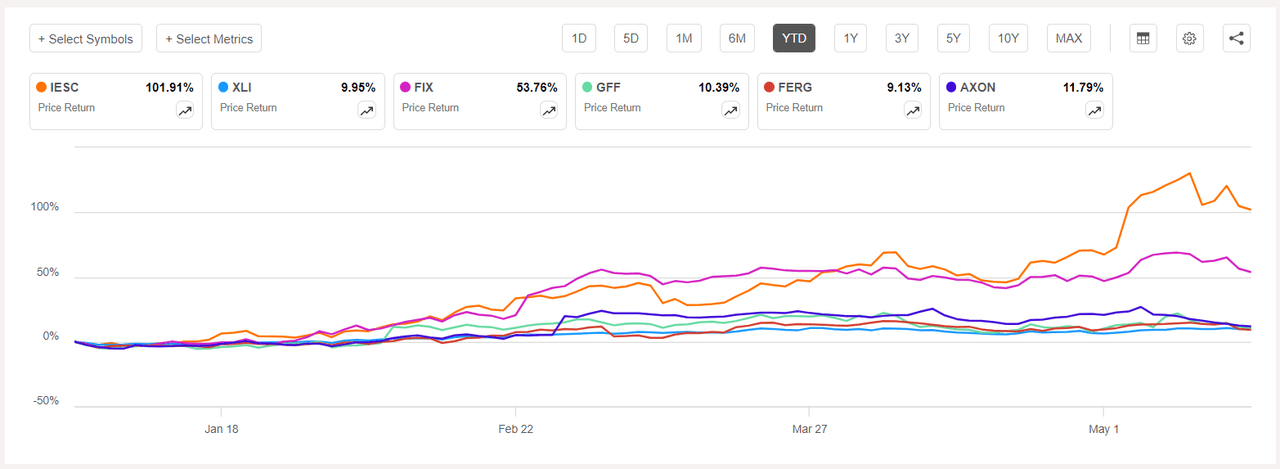

Year-to-date, or YTD, XLI has risen +9.95% and SPY has soared +11.39%.

The top five gainers in the industrial sector (stocks with a market cap of over $2B) all gained more than +10% each this week. YTD, 3 out of these 5 stocks are in the green.

Plug Power (NASDAQ:PLUG) +26.95%. The company, which develops hydrogen and fuel cell product solutions, saw its stock surge the most on Tuesday (+19.03%) after it said that it received a conditional commitment for a loan guarantee of as much as $1.66B from the U.S. Department of Energy. A day before, Plug was among the shares that soared (PLUG +12.89%) after the Biden administration announced plans for tariffs on Chinese solar firms. However, YTD the stock is in the red -27.78%.

PLUG has a SA Quant Rating — which takes into account factors such as Momentum, Profitability, and Valuation among others — of Strong Sell. The stock has a factor grade of F for Profitability and C+ for Growth. The average Wall Street Analysts’ Rating disagrees and has a Hold rating, wherein 18 out of 29 analysts tag the stock as such.

Embraer (ERJ) +19.33%. The Brazilian aircraft maker’s stock rose the most on Tuesday (+9.11%). YTD, +67.64%.

The SA Quant Rating on ERJ is Strong Buy with a score of A+ for Momentum and C+ for Valuation. The average Wall Street Analysts’ Rating is positive too, with a Buy rating, wherein 5 out of 13 analysts see the stock as Strong Buy.

The chart below shows YTD price-return performance of the top five gainers and SPY:

ZTO Express (ZTO) +17.94%. Shares of the Chinese logistics services provider jumped +10.24% on Thursday after first quarter results beat estimates. YTD, +15.55%.

The SA Quant Rating on ZTO is Hold with a score of A for Profitability and B- for Valuation. The average Wall Street Analysts’ Rating differs and has a Strong Buy rating, wherein 15 out of 21 analysts view the stock as such.

Loar Holdings (LOAR) +12.02%. Loar, which went for IPO in April, saw its stock rise throughout the week. The aircraft and defense systems parts maker also reported its first quarter results this week. YTD, +5.59%.

Bloom Energy (BE) +10.48%. The company’s stock rose +8.05% on Tuesday after announcing a collaboration with C3.ai to launch a program to integrate the C3 AI Reliability Suite for precision modeling of Bloom’s fuel cell performance and design.

On Tuesday, the U.S. government also said that it would raise tariffs on a range of Chinese imports, including electric vehicles and semiconductors. YTD, -16.69%. The SA Quant Rating on Bloom is Hold, while the average Wall Street Analysts’ Rating is Buy.

This week’s top five decliners among industrial stocks (market cap of over $2B) all lost more than -4% each. However, YTD, all these 5 stocks are in the green.

IES Holdings (NASDAQ:IESC) -12.26%. Shares of IES, which provides network infrastructure installation services, declined the most on Monday (-10.62%). The stock was also among the top fiver gainers since the past two weeks. YTD, +101.91%.

Comfort Systems USA (FIX) -8.29%. The Houston-based mechanical and electrical installation services provider’s stock dipped the most on Tuesday (-5.29%). YTD, +53.76%.

The SA Quant Rating on FIX is Hold, with a factor grade of B+ for Profitability and A+ for Momentum. The average Wall Street Analysts’ Rating differs and has a Buy rating, wherein 3 out of 4 analysts view the stock as Hold and 1 sees it as a Strong Buy.

The chart below shows YTD price-return performance of the worst five decliners and XLI:

Griffon (GFF) -5.36%. The home and building product maker saw its stock dip this week, but YTD, it has risen +10.39%. The SA Quant Rating on GFF is Strong Buy, with a score of A for Growth and C for Valuation. The average Wall Street Analysts’ Rating agrees and has Strong Buy rating too, wherein 4 out of 5 analysts tag the stock as such.

Ferguson (FERG) -4.89%. The Trian Fund cut its stakes in the plumbing and heating products’ distributor in the first quarter, billionaire investor Nelson Peltz’s fund disclosed the information in its latest 13F filing, published on Wednesday. YTD, +9.13%.

The SA Quant Rating on FERG is Hold, with a factor grade of A for Profitability and D- for Growth. The rating is in contrast to the average Wall Street Analysts’ Rating of Buy rating, wherein 10 out of 19 analysts see the stock Strong Buy.

Axon Enterprise (AXON) -4.82%. The Taser maker’s stock dipped throughout the week. YTD, +11.79%. The SA Quant Rating on AXON is Hold, while the average Wall Street Analysts’ Rating is Buy.

More on IES Holdings and Plug Power

Source link