The conflict in Ukraine has sent the oil price through the roof! Sanctions on Russian Banks and companies have led to a stampede into U.S oil stocks.

The Professor gave subscribers the idea first on Friday, Feb 25th, and the stock has continued higher since.

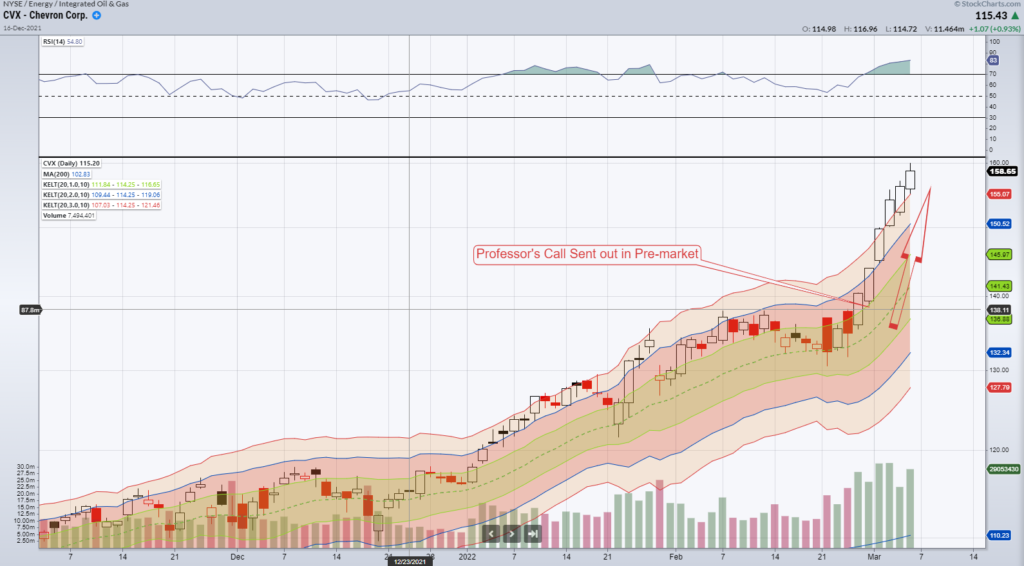

The setup was an ascending triangle in CVX. Quite often technicals precede news and fundamentals. And when Russia started to get cut off from western business partnerships last week, and trading in stocks on their market got suspended, the big money came flooding into CVX. Here’s the move after the Professor’s call:

Chevron Corporation (CVX), through its subsidiaries, engages in integrated energy and chemicals operations worldwide. It is involved in the exploration, development, production, and transportation of crude oil and natural gas; processing, liquefaction, transportation. It also engages in refining crude oil into petroleum products; marketing crude oil, refined products, and lubricants; manufacturing and marketing of renewable fuels; transporting crude oil and refined products by pipeline, marine vessel, motor equipment, and rail car.

With the oil price spiking and approaching $100, the fundamentals for oil companies haven’t been this good in a long time.

In fact, after the Professor’s idea, oil futures spiked to a price over $120.

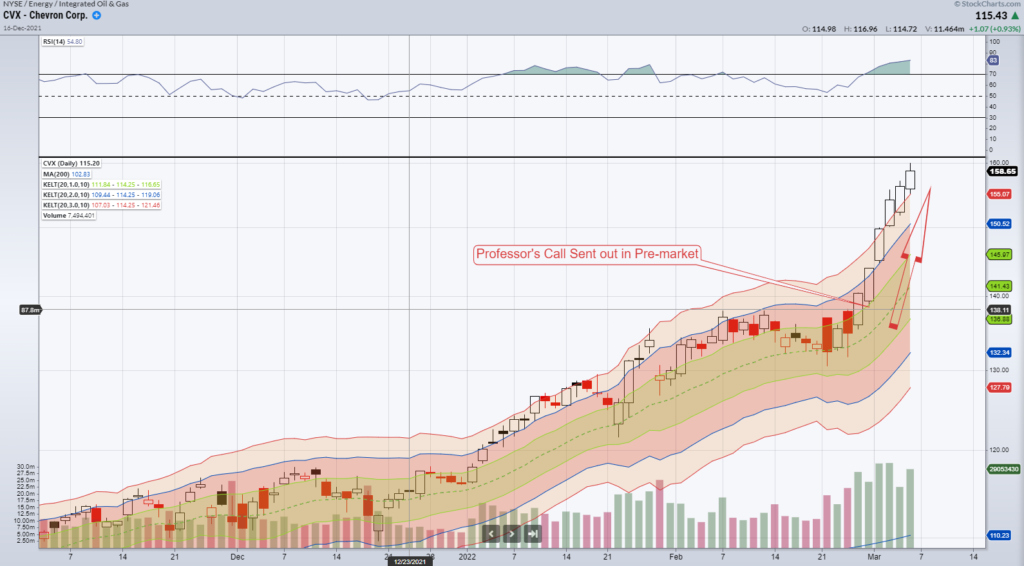

Here was the trade setup:

Technicals

This trade is setting up with three great patterns, a push on the upper resistance level and positive momentum on the TTM Squeeze. With On Balance Volume showing positive numbers, I’m expecting the bulls to remain in control here.

With these three bullish signals, I’m expecting to see a breakout to the upside as the bulls step in to take control here.

Here’s what happened next:

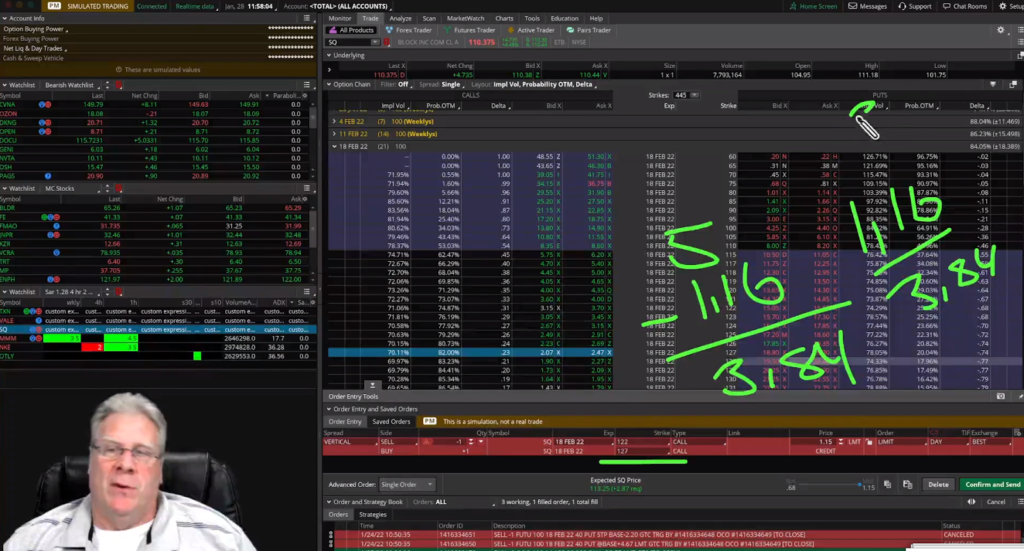

The Professor wasn’t able to get a fill on this trade, but the Idea was really early to the party. Oil stocks have been on a tear since! Finding hot sectors, even when the market may be weak is Mike Parks specialty!

The Professor, Mike Parks, is Raging Bull’s Senior Training Specialist.

Mike is a veteran trader and educator and is adding a level of insight to Total Alpha that can only come from decades of experience in trading and market education.

Mike has incredibly knowledgeable on all things markets and his talent for teaching new traders how to use market signals to choose the right options strategies is unmatched.